Winner’s Corner

- John Webb from VA won $100 in our quarterly new member drawing

- Kenneth Elgert from VA won $150 in our Summer Splash sweepstakes

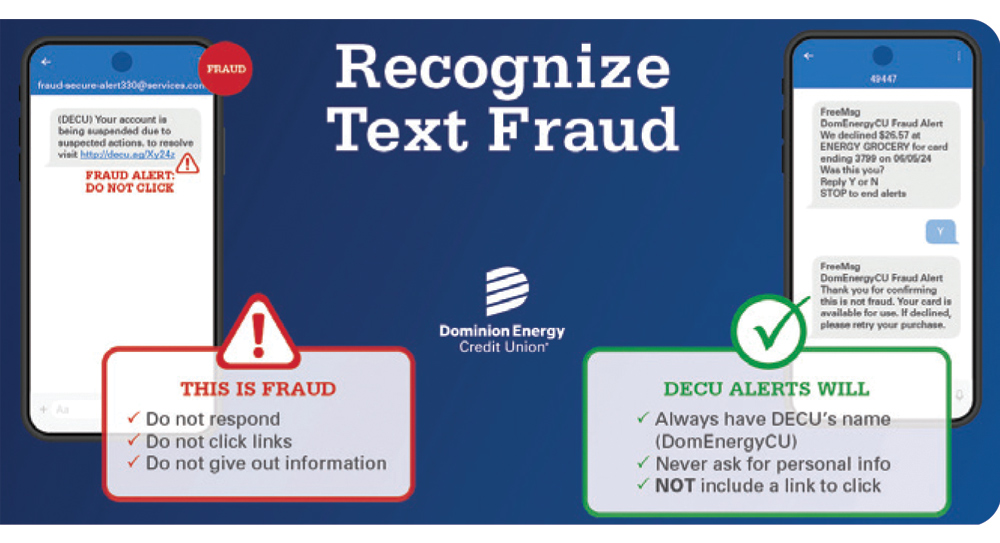

Protect Yourself From Text Fraud

Text alerts are a convenient way to know if potential fraud is occurring on one of your accounts. However, these also make you more vulnerable to scammers that hope you’ll tap a link or reply. Once you do, the scammer can request sensitive information or download malware that steals it automatically.

- Think before you click - Never click on any suspicious links or call unknown numbers. Instead, go to the site from a trusted URL and navigate to the page from there.

- Watch out for red flags - Look out for misspellings, vague information, or pressure to resolve the issue right away. Instead, reach out to the institution via a trusted number.

- Secure you information - Keep your passwords secure and use multi-factor authentication when you can. We will never ask for personal information via text.

Bill Payer Q&A

Q: When using Bill Payer, when does the company or person receive my payment?

A: If the company or person you’re paying can receive electronic payments, the money is typically delivered in 1-3 business days. If they cannot receive payments electronically, we mail them a paper check which typically takes 3-5 business days.

Tip: Be mindful of mail system delays and consider scheduling delivery sooner than the due date if a paper check is needed.

Protect Yourself with Alerts

With the holidays approaching you may find yourself making more than the usual amount of purchases and it can be hard to keep track. With Digital Banking and alerts, you can keep tabs on your accounts anytime and anywhere. Plus, alerts help you take action against fraudulent activity as soon as it occurs.

Purchase Alerts

Get a text or email whenever you pay with your Visa card. You can also set notifications that are right for you such as reaching a purchase threshold, international purchases, and purchases made on the internet or over the phone. Visit our website to learn more.

Account Alerts

Get notified when certain account activity occurs, such as a deposit is made or your balance dips below a threshold. Sign up within Digital Banking.

Card Alerts

You can also use our Card Control app to quickly sign up for a variety of different credit and debit card alerts. Protect yourself by taking advantage of these powerful money management tools.

Holiday Loans to Light Up Your World

The holidays should be about cheer – not money fears! Make the holiday season glow by expanding your budget. Get into the spirit with our holiday loan special at DECU! It’s a jolly good deal!

- Rates as low as 11.75% APR*

- Terms up to 24 months

- Loan amounts up to $3,000

Use the money to fulfill wish lists, deck the halls, finalize your travel plans and more!

This special offer is only available from October 1 –

December 31, so don’t wait to get started.