Winner’s Corner

- Roosevelt Word from SC won $100 in our quarterly new member drawing

- Leon Peebles rom SC won $300 in our winter membership campaign

- Alfred Hoornik from VA won $100 in our Member Spreading the Love campaign

- Mark Tayloe from VA won $300 in our Credit Card Balance Transfer campaign

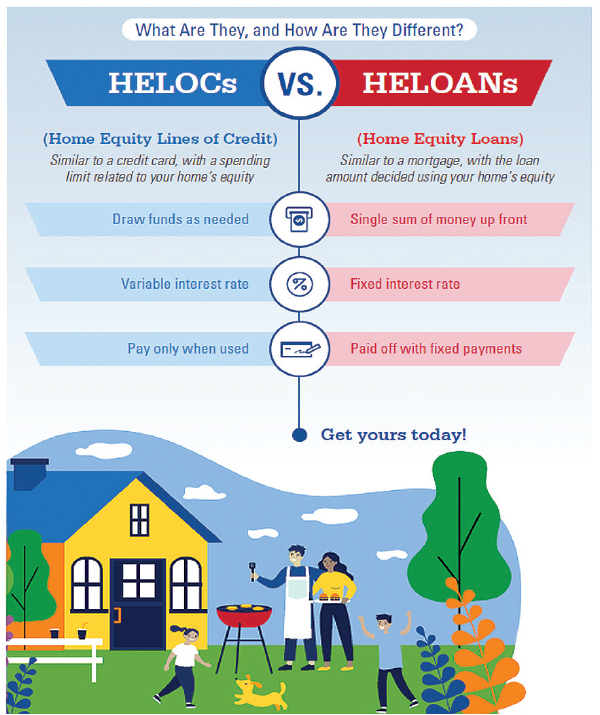

Home Equity Loans vs Lines

Since home equity funds can be used for almost anything, there are lots of ways to make your home work for you. But here’s your first decision: Do you want all your money right now or would you prefer to borrow it as needed? Use this chart to help you decide. Once you’re ready to get the cash you need, give us a call. Our online application makes the process easy!

Take Control of Your Credit

Lenders use your score to determine your creditworthiness, meaning how reliable you are when it comes to paying back debts on time. The higher your credit score, the lower the rate you pay on loans, and the more money you save.

Get Daily Updates in Digital Banking: We make it easy to access your credit score, credit report, credit monitoring, education, and more for free at any time with Credit Score and More. Plus, you’ll get tips tailored to you on how to improve your score!

Get started: Simply log in to Digital Banking and click “Credit Score” on the menu. This credit score service is a “soft inquiry” and does not affect your score.

INTRODUCING ID CHECK

Shared Branches are Now Easier and More Secure!

New ID Check Adds Extra Security at Shared Branches

With account takeover fraud on the rise, we’ve added new ID proofing security when accessing your account in-person at Co-op Shared Branch locations. This new fraud prevention measure allows us to make certain it is YOU trying to access your account versus an imposter.

How it Works:

- Scan the QR code located in the branch or visit verify.coop.org.

- Select Dominion Energy Credit Union from a drop-down list.

- Enter your member number and the last four digits of your social security number.

- Upload a photo of your ID.

- Take a selfie.

Tip: Save your validation for an even quicker experience next time!

Show your one-time passcode to the teller (passcode is valid for 20 minutes). If you have any questions or concerns, please reach us at 800-268-6928 or mycu@dominionenergy.com.

2025 Annual Meeting

Join us for fun, food, and prizes.

Time: 11:00 am – 1:00 pm

When: July 1

Where: Dominion Energy – North Anna