Winner’s Corner

- Debbie Carr from UT won $300 during our spring auto loan promotion.

- Octavia Anderson-Williams from NC won $100 in our quarterly new member drawing.

- Darlene Brock from VA won $150 during our Spring Into Fun giveaway.

- Lauren Lafoon from VA won $300 during our Credit Card Balance Transfer campaign.

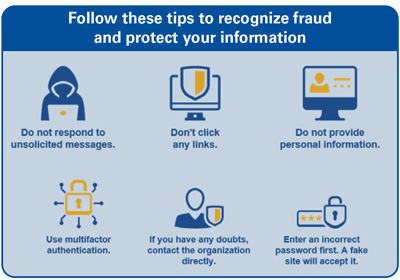

*SCAM ALERT* Your safety is our top priority!

We’ve seen an increase in fraud – here’s what you need to know to help keep safe.

We will NEVER call, text or email you asking for account information.

If anyone unexpectedly contacts you claiming to be DECU, stop communicating and call us directly at 800-268-6928.

Please tell the representative exactly what is happening, and we can verify whether it was an official communication. We are here to protect you and do our best with all the details!

Thinking About Buying a Home?

8 important questions to ask.

With mortgage rates declining slightly you may be considering buying a home. In order to make the best decision possible on your mortgage loan, there are a few crucial questions you should ask.

What are the current mortgage rates and fees?

Mortgage rates change daily, visit our website to see what the current rates are for our mortgage products. Ask about discount points to buy down the rate.

What are the loan program options?

There are many to choose from and each has pros and cons to consider. Find the right fit based on downpayment, credit score required, and your financial situation.

What down payment is required?

The minimum down payment can vary, for example a first-time homebuyer can put down as little as 3% of the purchase price on a conventional mortgage.

How much can I afford?

The loan amount you can be approved for will depend on how much of a down payment you are able to make, as well as your current expenses compared to your income. It’s important to take a close look at your budget to ensure you can afford your projected housing costs and other expenses that come with homeownership.

How long is a mortgage pre-qualification valid?

This varies by lender. At Dominion Energy Credit Union, a pre-qualification is valid for 90 days, so you have plenty of time to search for the right home for you.

What are the estimated closing costs?

Closing costs are typically 2%-5% of the home’s purchase price. By reviewing an estimate you’ll better understand the upfront expense.

What is the rate lock period?

A rate lock guarantees your quoted rates won’t increase for a set period, usually 30-60 days.

What are the steps after pre-qualification?

Understanding the next steps and timeline helps you know how long you have to shop, get a contract, secure an appraisal, and get final approval.

Consider these and other factors when buying a home to make the best decision for you.

Have more questions? We’re here to help! Call 804‑521‑2525, option 3 or email us at

decumortgage@dominionenergy.com